National News

Homebuilders expressed “cautious optimism” that the lack of existing inventory would drive demand for new homes despite high construction costs and interest rates, the National Association of Home Builders reported.

The Mortgage Bankers Association noted the increase in borrowing activity came despite the 30-year fixed mortgage rate climbing to its highest level since November 2022.

In January, home prices were up 5.5% annually and down 0.2% monthly, CoreLogic reported, citing its monthly Home Price Insights report.

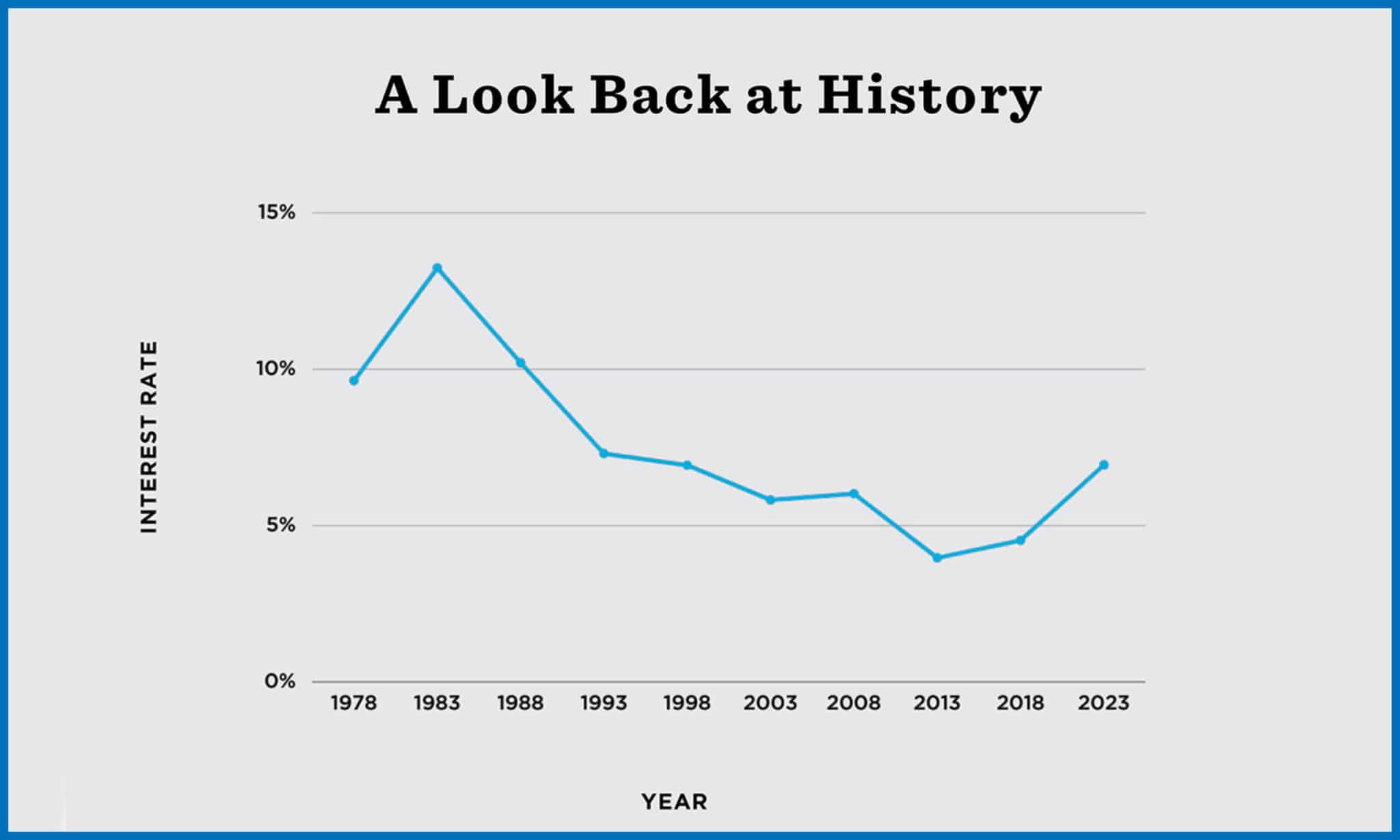

Keeping things in historical perspective can be tough when mortgage rates have roughly doubled in the last year. Mike Del Preto, a senior mortgage advisor at Fairway Independent Mortgage Corporation, helps provide a closer look at the numbers.

Nearly 55 years after the Fair Housing Act was signed into law, Black homeownership still lags behind white homeownership.

Many feel they could have made a higher profit if they’d made better decisions. But are those regrets valid?

The S&P CoreLogic Case-Shiller U.S. National Home Price Index rose 5.8% year-over-year in December, compared to a 7.6% gain in November.

The 8.1% month-over-month increase in the National Association of REALTORS® Pending Home Sales Index was the largest gain since June 2020.

The median sales price of a new home declined on both a monthly and yearly basis, however, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

Mortgage insurance premiums on loans backed by the Federal Housing Administration will drop from 0.85% to 0.55% beginning March 20.

The former Keller Williams lending unit will operate alongside Mutual of Omaha Mortgage’s existing mortgage divisions.

The 30-year fixed-rate mortgage averaged 6.32% as of Feb. 16, up from 6.12% a week before and 3.92% a year earlier.

The pace of mortgage applications fell 7.7% in the week ended Feb. 10, the Mortgage Bankers Association reported.

Builder confidence rose for the second consecutive month in February with a seven-point increase that brought it to its highest level since last September, the National Association of Home Builders said.

The REALTORS® Relief Foundation works to provide housing relief to victims of natural disasters.

The 30-year fixed rate fell for the fifth week in a row, giving a lift to lending activity, the Mortgage Bankers Association said.